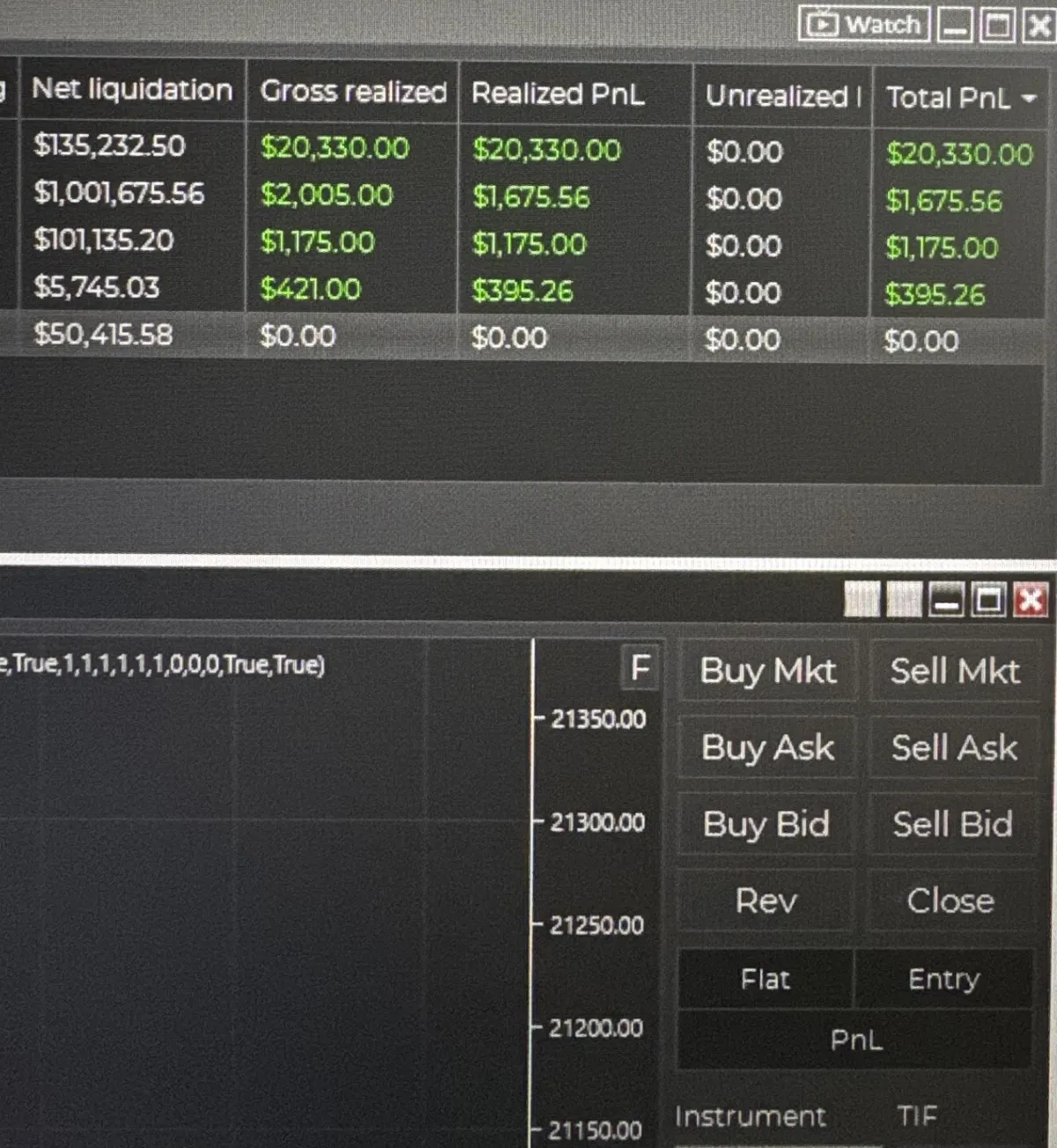

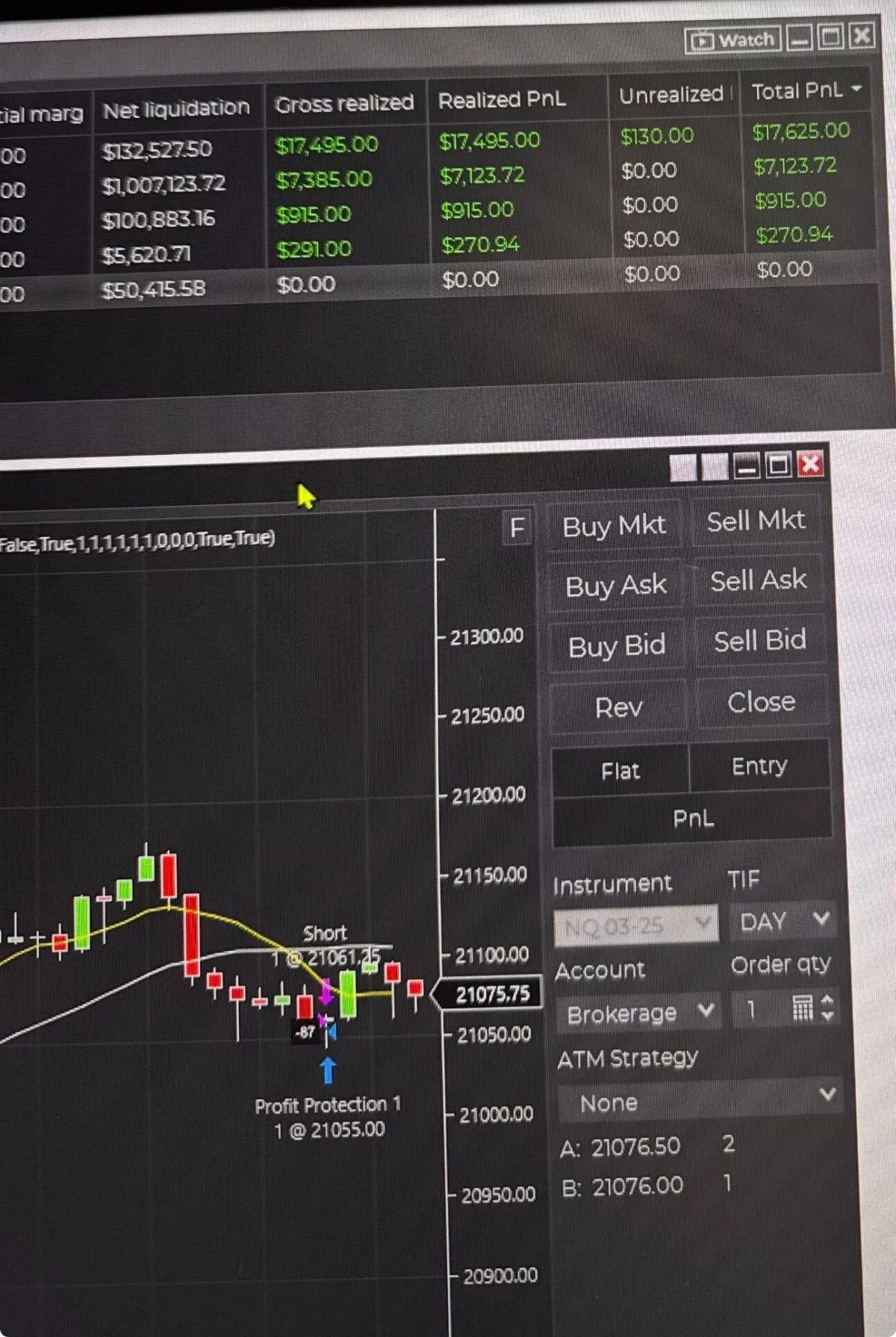

Get up to $1M in Funding with Our Hedge Fund-Backed

Trading Software

Unlock High-Capital Trading with Our Proprietary Trading Software.

Get Funded, Trade Smarter while Protecting your own Capital

Why Choose Us?

Our Edge

Our hedge fund-backed software helps you qualify for up to $1M in trading capital, running on a regulated US brokerage. Built by industry professionals to help you reach your trading goals.

Get Set up in less than 1 Day

We do all the heavy lifting – full onboarding, painless setup, and expert guidance to get you trading FAST with White Glove support.

Trade with $0 of Your Own Money

Use prop firm capital to trade and keep the profits – no personal funds risk required.

Systematic Trading

Monitor just 10 Minutes a Day – Let our software do the heavy lifting.

Trading can be complex, our process is not.

Battle-Tested

No Trading Experience Required

Can perform while you sleep

Fast-track access to top Funding Firms

The Process

Our Process for Success

Get up in running in less than a day

Step 1

Subscribe to our Trading Software

Download Ninja Trader 8.

Step 2

Install the Software

Once subscribed, setup takes less than 10 minutes and you can begin trading.

Step 3

Use your own capital or leverage a Prop Firm

Trade your own capital or get funded trading capital from a prop firm.

Step 4

Get Paid

Begin earning profits on your Funded Account(s).

Testimonials

Customer Testimonials

FAQ's

Have Questions? We Have Answers

Here are commonly asked questions from our customers.

If you can't find the answer you're looking for, feel free to contact us directly.

What is trading Software?

- A trading algorithm is computer software a user can install on their laptop or computer. It is a systematic investing strategy used to trade the financial markets. Structured Wealth has developed proprietary software with built in risk management and rigorous testing to take advantage of dynamic price movements in the US futures market. Many of our strategies execute with incredible speed and precision a manual trader otherwise would have great difficulty to perform.

Can I trade if I don't have the Capital?

Yes, Proprietary Trading Firms will provide you capital to trade with, and in return you share a portion of the profits you generate. Why would a prop firm give you money? Their business model is predicated on them making money when you succeed, as they receive a share in the profits. Prop Firms require you to pass an evaluation, often with strict parameters on how you risk and trade their capital. Our Trading Software is designed to meet these risk management requirements and pass their defined profit Prop Firms set within less than 4 months, or we'll refund your purchase.

Are Prop Firms Legitimate?

Yes, trading in the Futures Market is highly regulated Industry, the prop firm we use are also regulated and legitimate.

You may have seen ads for Trading Software online that exclusively trades Forex Markets, that is more common because Forex is not regulated and other prop firms specializing in Forex incur far less regulation, we have 100% payout track record with our group.

Payouts are usually processed within 2 business days.

How does it perform during Market Downturns?

Our Strategy is market neutral, meaning it takes both long and short positions. All trading is done intraday with no positions held overnight. Although rare, there could be days market conditions will render our software to not make any trades.

Why not keep these Trading Strategies for yourselves?

Prop Firms are designed to benefit both the Trader and their firm. We saw an opportunity to help traders leverage systematic strategies to help them get access to capital they would otherwise fail at passing over 90% of the time. Also, our Founder had already built a Hedge Fund whereby developing Trading Strategies is already part of the day to day operation. Structured Wealth was founded by Industry professionals who wanted to give back to Traders like themselves.

What sets Structured Wealth apart from other Trading Software?

Our Trading Software was developed by a Full Time Developer who's developed thousands of various trading Strategies, specifically strategies dedicated to Futures trading. Our Founder has also spent over a decade investing and trading in various Strategies as a licensed Financial Professional holding a series 7 and 63 since 2014 which can viewed on BrokerCheck. In addition to founding Structured Wealth Trading, our CEO also serves as the Managing Partner of Swanson Reserve Capital an Alternative Fixed Income Fund for Accredited Investors. Lastly, we offer a free trial - we are the ONLY company based on our market research offering a trial.

How much does it cost?

Our software and service was developed and priced based on the value it can provide - which can unlock up to 1,000,000 in funded account capital.

12 mo. Licensing: $14,997.00*

Lifetime Subscription: $24,997.00*

Monthly Maintenance Fees: None

Ongoing Customer Success & Support

Updates to all new Strategy iterations

Additionally, our pricing is backed by our Funded Account Pass Guarantee, ensuring you may unlock risk free capital to earn with within 4 month's of purchase.

Pricing is subject to change without notice*

Our Mission

Welcome to Structured Wealth Trading, bringing Hedge Fund level Algorithms to the retail market.

Limited Offering

To ensure a quality customer experience, Structured Wealth Trading reserves the right limit the amount of licenses we offer in any given month, often as little as 10 subscribers monthly.

Our algorithms are updated periodically and we're committed

to ensuring our Strategies are optimized for our clients.

5550 Glades Road, Suite 500 #1156 Boca Raton, FL 33431

US, Florida, USA

Testimonial Disclosure

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Risk Disclosure

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or cause major financial harm. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets. This presentation is for educational purposes only and the opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.major financial harm. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

© Copyright 2025 Swan Cap LLC | All Rights Reserved.